In Ireland, you get back 10% of your total electricity/heat expenses and 30% of your internet bill for the days you’re working from home. This will be the case for the year 2020 and 2021. For 2022, you will get back even more, 30% for both electricity/heat and internet.

Claiming this is quite simple enough. Just follow the below steps:

- Log in to revenue.ie

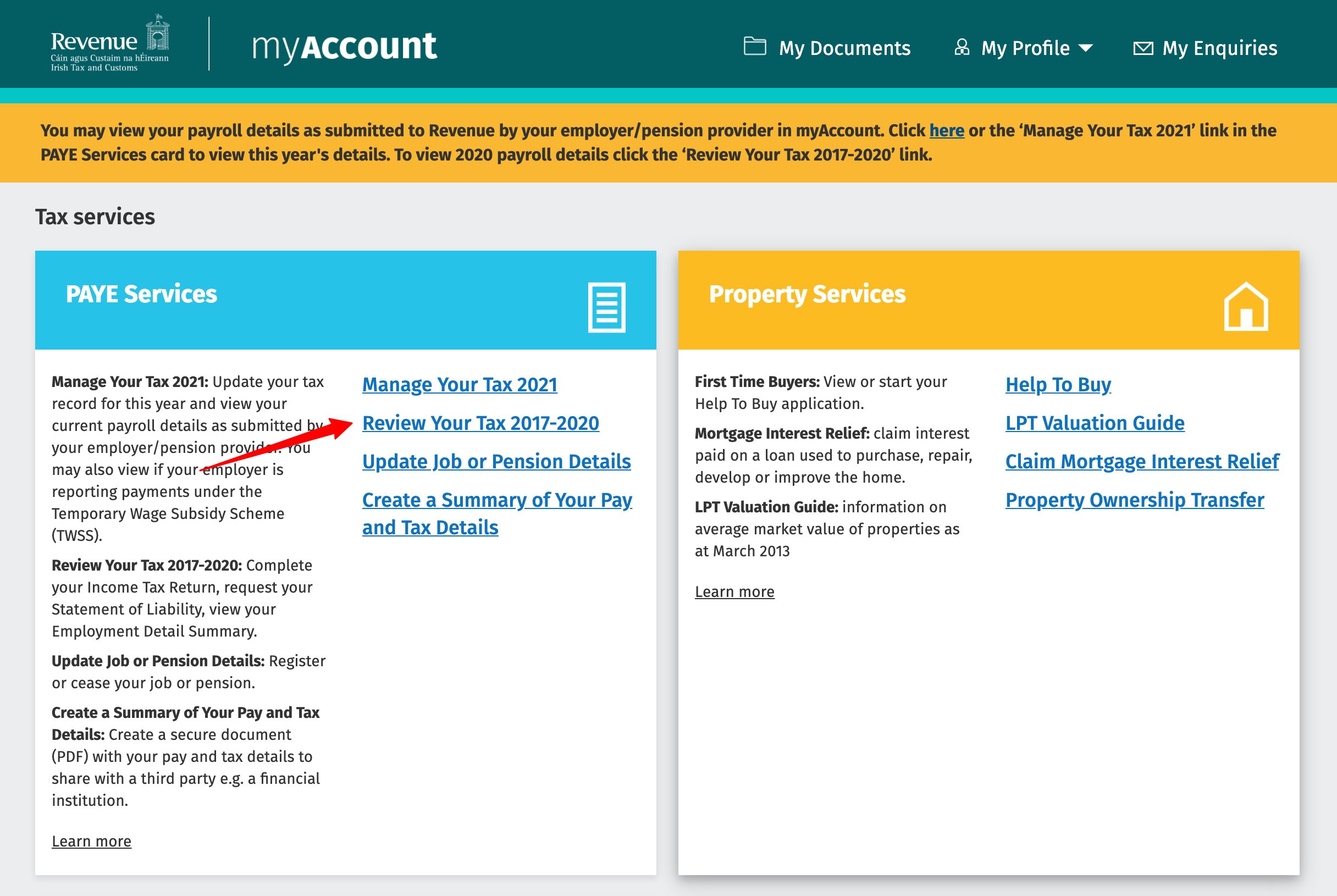

- Under PAYE Service, click ‘Review Your Tax 2017-2020’

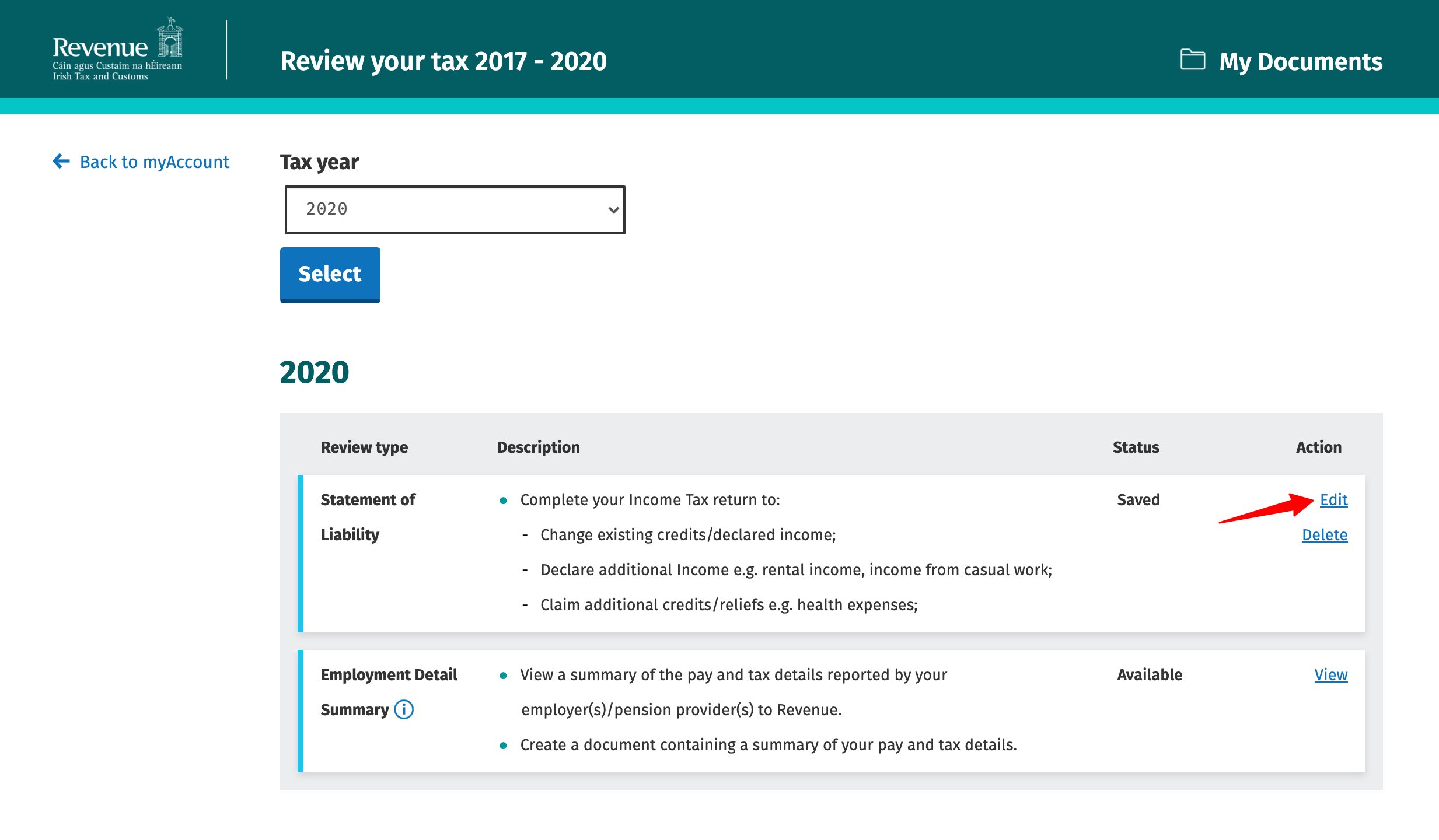

- Edit your Income Tax return

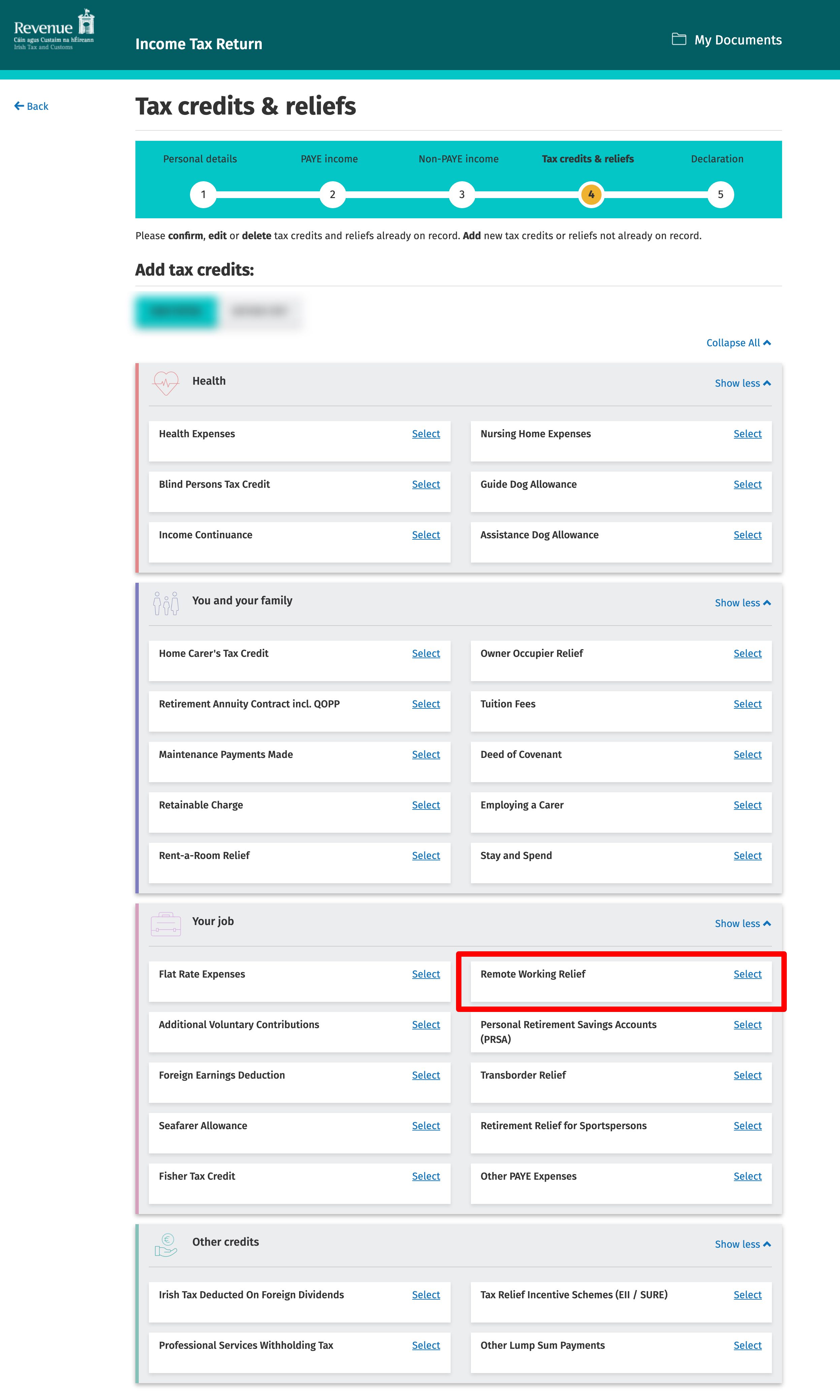

- Keep clicking ‘Next’ until you come to ‘Tax Credits’. Once you’re here, click on ‘Remote Working Relief’ under ‘Your job’

-

The last step is to fill in the amounts and the days you’ve worked from home. If your employer pays you towards these expenses then select ‘Yes’ or else ‘No’.

That’s it. You’re done. The final tax credit will automatically be updated and you don’t need to do any further calculations yourself.

Please, feel free to share this among your friends if they aren’t aware of the benefit. Stay safe.

FAQ

Q1. What if I live with others and share the bill?

A1. Then you reimburse only the portion you pay. Others would do the same.

Q2. Do I consider bank holidays/weekends when counting total working days?

A2. No. Use the number of days that you were actually working, not weekends or holidays nor paid/unpaid leave.

Q3. What if I am using mobile phone data or have a combined internet/tv bill?

A3. If this is the case, then claim only the mobile data portion of the phone bill or only the internet charges of the internet/tv bill.