There are many ways you can make your crypto savings work for you but I am going to list down two of the most well-known ones that I personally use most frequently.

1. Crypto lending platforms

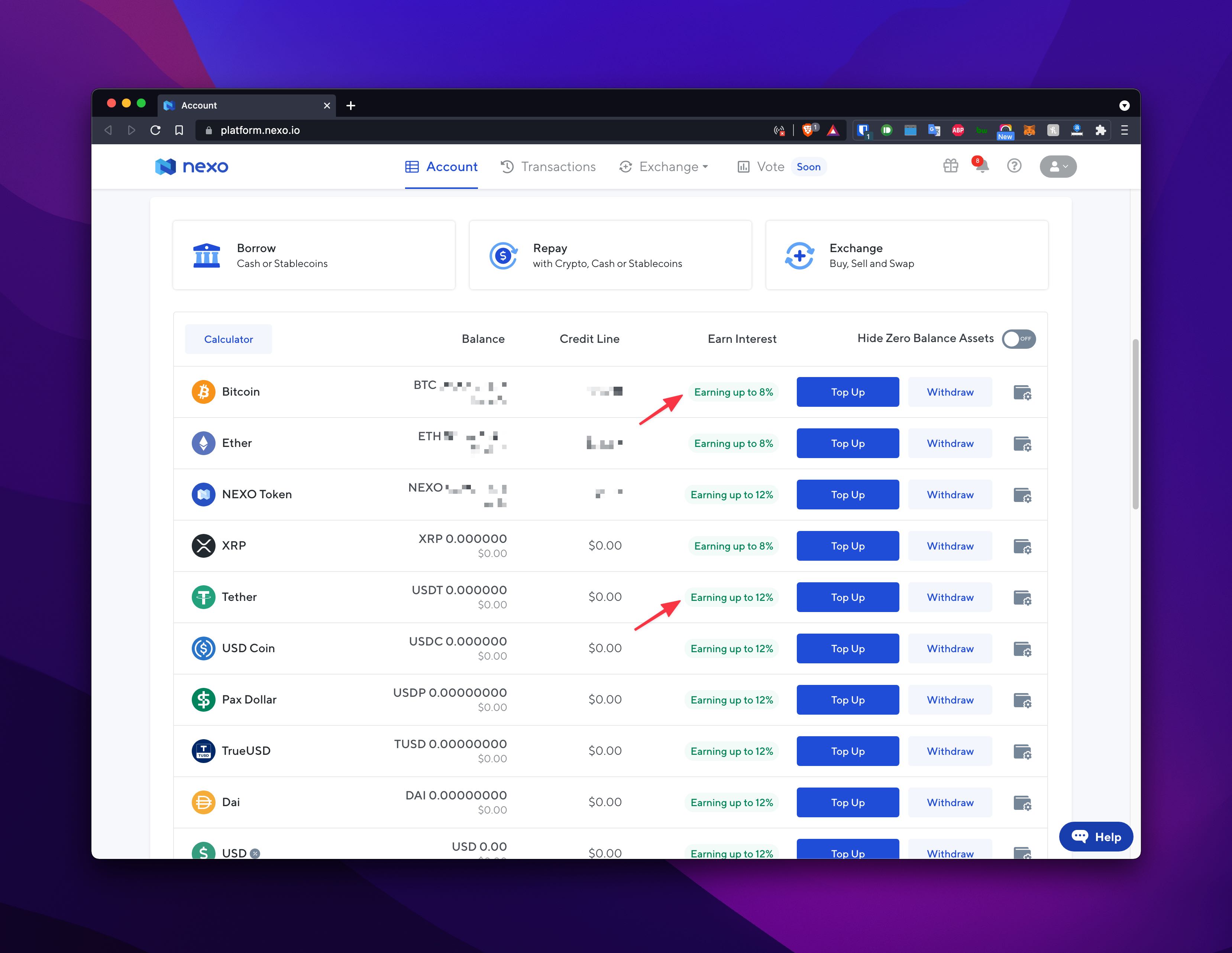

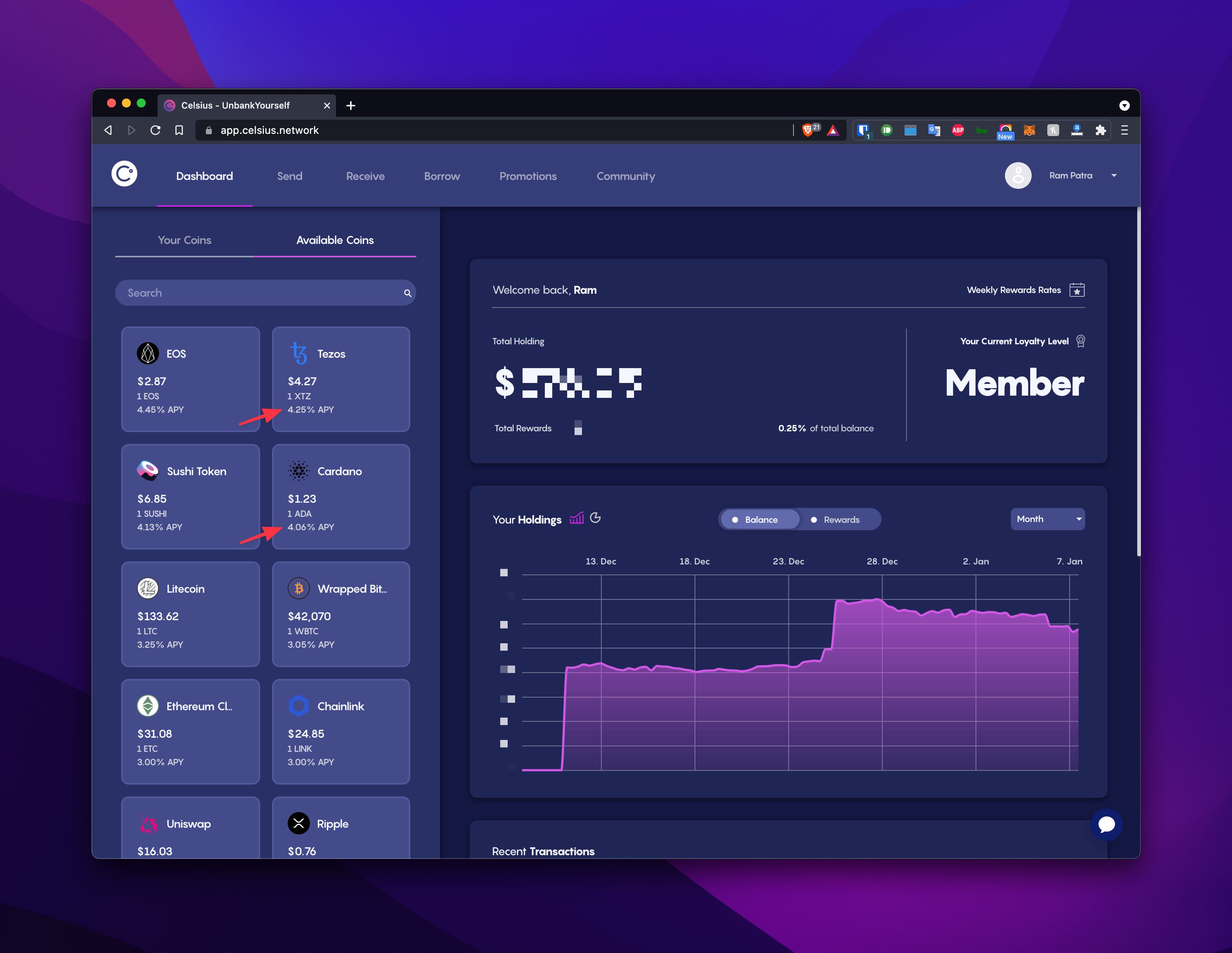

With the proliferation of cryptocurrency in the world, we are seeing a new kind of platform where people can take crypto loans and like any other loan, they pay interest based on the amount they owe. These platforms allow others who already own crypto to save their savings there and get interest in return or they can even buy directly on their platform like they do on an exchange and earn interest out of it for storing the same on their platform. Some examples of such services that I’ve personally used are Nexo, Celsius, BlockFi, Hodlnaut, etc.

Among all, I use Nexo and Celsius mostly. Nexo because it has a simple and robust app that looks appealing, has decent interest rates on currencies such as Bitcoin, Ethereum, etc., and, last but not least, it has $375 million insurance on digital assets.

Celsius mainly because of their higher interest rates on specific cryptocurrencies. I haven’t fully used BlockFi or Hodlnaut yet but I do have their apps installed and my account verified there. I feel these two apps need to improve a bit and provide better rates and support for more cryptocurrencies.

Anyway, if you want to try out these services then feel free to use my referral links to earn free cryptocurrency. All have some offer or the other at the time of writing this blog post but not sure if they would be there forever. Either way, you can check by clicking the respective links. Nexo is currently giving $25 if you deposit/buy $100 worth of crypto and keep it in their platform for at least 30 days. Celsius is giving $50 if you deposit/buy $400 worth of crypto and keep for 30 days. You can withdraw fully after 30 days from both of these platforms.

2. Staking

We know that there are two most widely used consensus algorithms in blockchains, i.e., Proof of Work (Bitcoin, Ethereum, etc.) and Proof of Stake (Ethereum 2.0, Cosmos, Tezos, etc.). In the former, miners (GPUs/ASIC) have to solve complex mathematical problems to validate each block that goes to the blockchain, and in the latter, validators stake their own money in the pool and take part in validating blocks that go to the blockchain. If they play dirty then they pay a fine from their staked money.

Becoming a direct validator can be challenging but famous exchanges like Binance and Coinbase provide an easy way to stake coins. On Coinbase, you just buy the coin that uses the Proof of Stake algorithm like you buy any other coin and enable Stake rewards on their app. That’s it. With Binance, you can go to your main menu and then Earn and then Stake. Here you can choose the coin you want to stake and for how long you want to stake.

According to my experience, Binance provides better staking rewards and their charges are cheaper than Coinbase but it’s better to compare both and stake accordingly as the rates keep changing.

Lastly, feel free to use my referral links for Binance and Coinbase. For Binance, you should see a 10% reduction in charges for all your transactions forever, and with Coinbase, you would get $10 worth of BTC after signing up.

Conclusion

If you compare the two, the first option provides more yield but I don’t like to keep all of my eggs in the same basket and therefore, I use both of them. I use the former for coins that don’t support staking and the latter option for coins that support staking. I see no point in having my Bitcoin sit in my Coinbase wallet and do nothing whereas keeping the same Bitcoin in my Celsius wallet gives me a 6.2% yield annually.

If you’re interested in mining cryptocurrency then you can read my earlier blog post here or if you’re interested to earn some free crypto then you can read this blog post.